The Government e-Marketplace (GeM) has revolutionized India's procurement process by providing a digital platform for government organizations and vendors to transact efficiently. As a seller on GeM, it is crucial to understand the TDS (Tax Deducted at Source) certificate upload process, which is mandatory for transactions or annual milestone charges exceeding 5 lakhs.

In this blog post, we will guide you through the step-by-step procedure of uploading the TDS certificate on GeM to ensure smooth order acceptance. We have also created a detailed tutorial video, which you can find on our YouTube channel for visual assistance.

Importance of Uploading TDS Certificates on GeM

The TDS certificate is a vital document required by GeM to ensure compliance with tax regulations.

It serves as proof that tax deductions have been made and deposited with the authorities as per the Income Tax Act, 1961.

By uploading the TDS certificate, sellers demonstrate their adherence to tax norms and create a transparent environment for transactions on GeM.

Want to sell your products on GeM?

Talk to an expert to onboard your product on GeM

Call Now

Mandatory TDS Certificate Upload

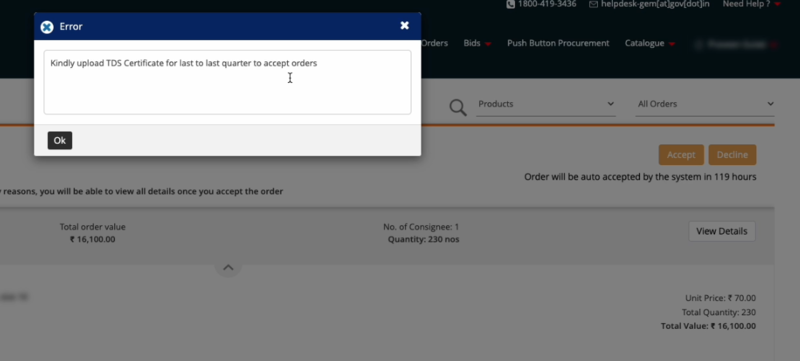

It is important to note that sellers cannot accept new orders on GeM unless they upload the TDS certificate for the last quarter.

This requirement applies to all transaction charges or annual milestone charges exceeding 5 lakhs.

To streamline the process and avoid any disruptions in order acceptance, sellers must promptly upload the TDS certificate on GeM.

Step-by-Step Guide

How to Upload TDS Certificate on GeM Portal:

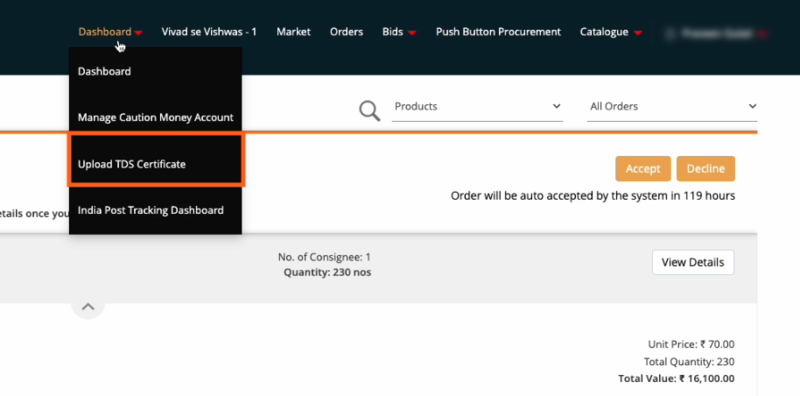

- Log in to your GeM seller account: Access your GeM seller account using your credentials on the GeM portal (https://gem.gov.in/).

- Navigate to the

Upload TDS Certificatesection: Once logged in, locate theTDS Certificatetab or section within your seller dashboard. It is usually found under theDashboardsection.

- Prepare the TDS certificate: Ensure that you have a valid TDS certificate for the respective quarter. The certificate should include details such as the deductee's name (seller), deductor's name (buyer), TAN (Tax Deduction and Collection Account Number), transaction amount, and tax deducted. You can download the TDS Certificate from the TDS Traces Website on Form 16A.

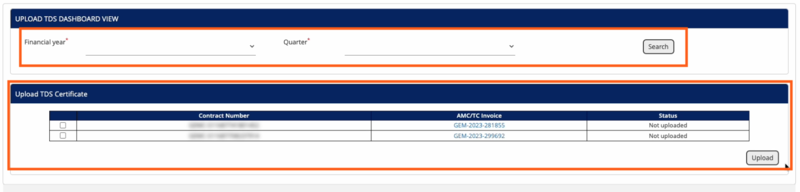

- Search for the pending transaction invoices: Select the appropriate financial year and quarter, then click on search

- Click on the

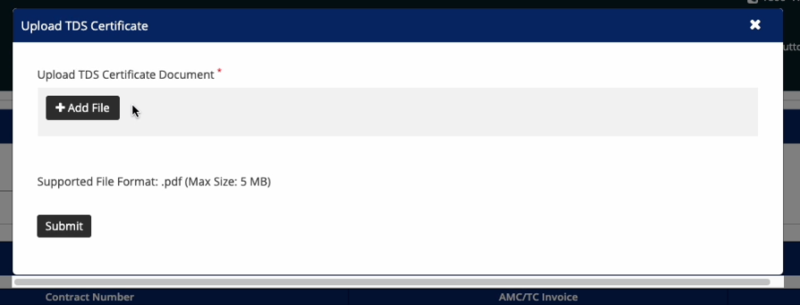

Uploadbutton: In theUpload TDS Certificatesection, you will find invoices. Select all invoices and click on theUploadbutton. - Select TDS certificate file: Merge all TDS certificates into a single PDF file (if you have more than one TDS certificate) and click on the

Submitbutton.

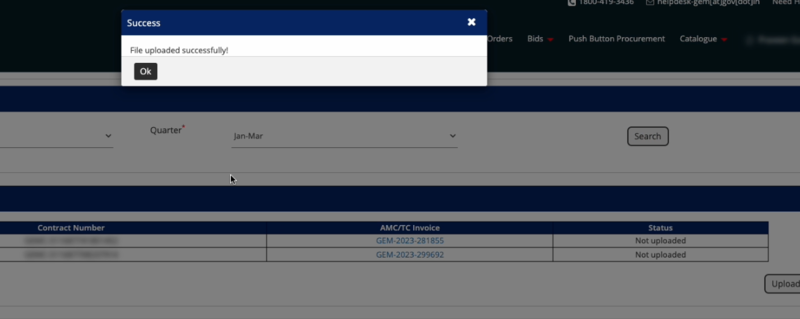

Once the upload is completed, you can see the confirmation as a popup.

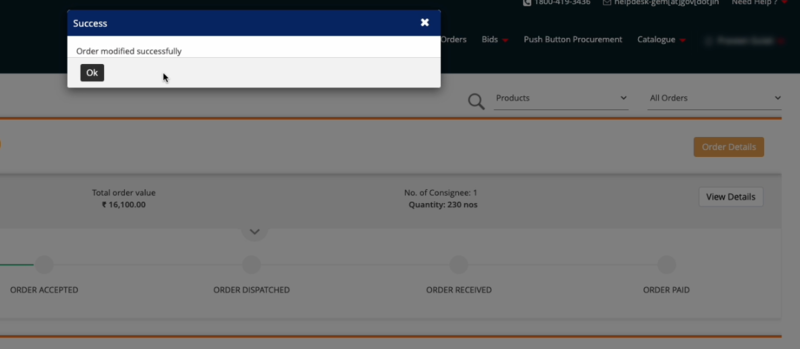

Let's accept the new order we received on GeM.

Video Tutorial

To assist you further, we have created a detailed tutorial video on how to upload the TDS certificate on GeM.

You can watch the video by visiting our YouTube channel Edafter or by directly accessing the tutorial video.

The video provides a visual walkthrough of the entire process, making it easier for you to follow along.

Conclusion

As a seller on the GeM platform, uploading the TDS certificate is a mandatory step to accept new orders valued greater than 5 lakhs.

By ensuring compliance and uploading the TDS certificate promptly, you create a seamless and transparent transaction process.

We hope this step-by-step guide and the accompanying tutorial video help simplify the process for you.

If you have questions or require further assistance, please feel free to reach out to our support team.

Remember, compliance with tax regulations not only strengthens your business but also contributes to the growth and transparency of the GeM ecosystem.

😊 Happy selling on GeM!