e-Invoicing on GeM

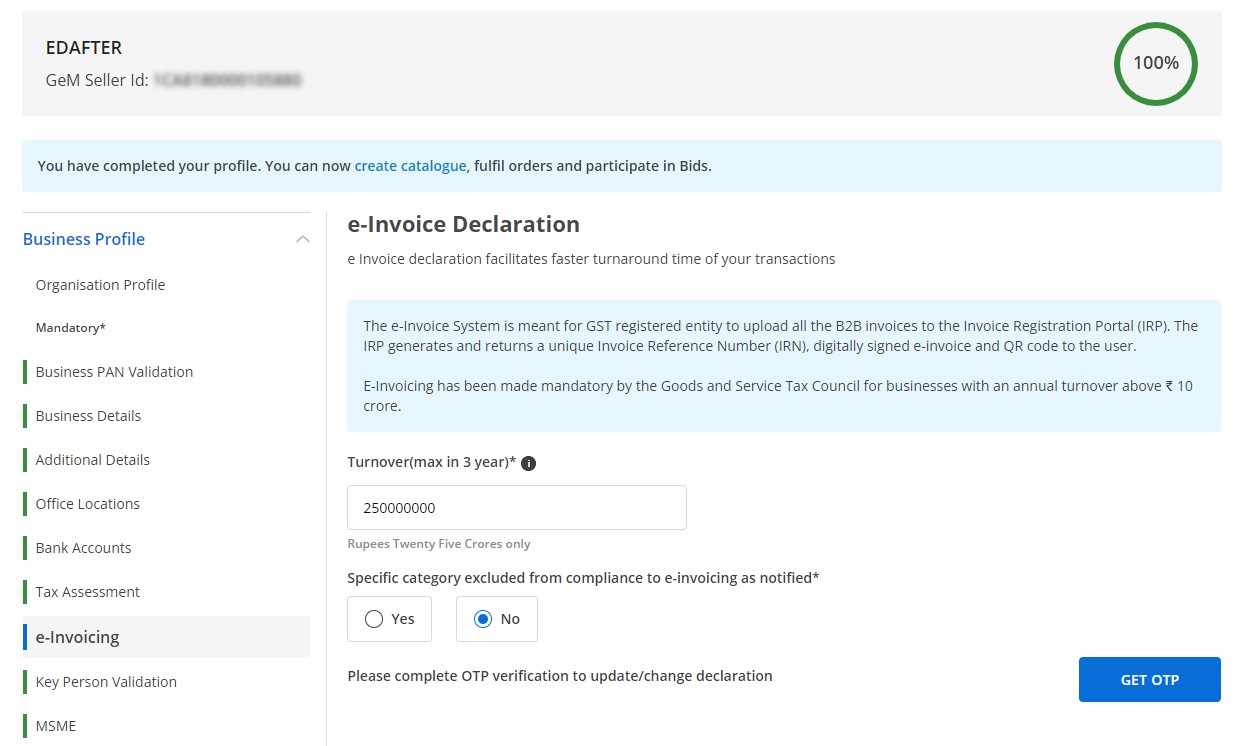

e Invoice declaration facilitates faster turnaround time of your transactions.

The e-Invoice System is meant for GST registered entity to upload all the B2B invoices to the Invoice Registration Portal (IRP). The IRP generates and returns a unique Invoice Reference Number (IRN), digitally signed e-invoice and QR code to the user.

E-Invoicing has been made mandatory by the Goods and Service Tax Council for businesses with an annual turnover above ₹ 10 crore.

What is e-Invoice?

"e-Invoicing" or "electronic invoicing" is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP), managed by the GST Network (GSTN).

To whom is e-invoicing applicable?

Following is the list of the applicable organization for e-invoices.

| Phase | Applicable to taxpayers having an aggregate turnover of more than | Applicable date | Notification number |

|---|---|---|---|

| I | Rs 500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| II | Rs 100 crore | 01.01.2021 | 88/2020 – Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 – Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 – Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 – Central Tax |

If you are in the above table, then you need to declare e-invoicing on the GeM portal.

Steps

- Turnover (max in 3 year) - Enter your last 3 years maximum turnover (should be greater than 10 crores)

- Specific category excluded from compliance to e-invoicing as notified - Select

Noas you have to declare e-Invoicing. - Click on

GET OTPand verify with the OTP you receive.

Unable to complete the profile. Need support?

Contact our expert team to assist you with it

Contact Now