Tax Assessment on GeM

Enter your ITR details to verify your Tax Assessment in your GeM Seller Profile.

Note

In case your date of incorporation is more than 24 months, and you are not providing your ITR records, then you will not be able to participate in bids. Your turnover will not reflect in the market as well.

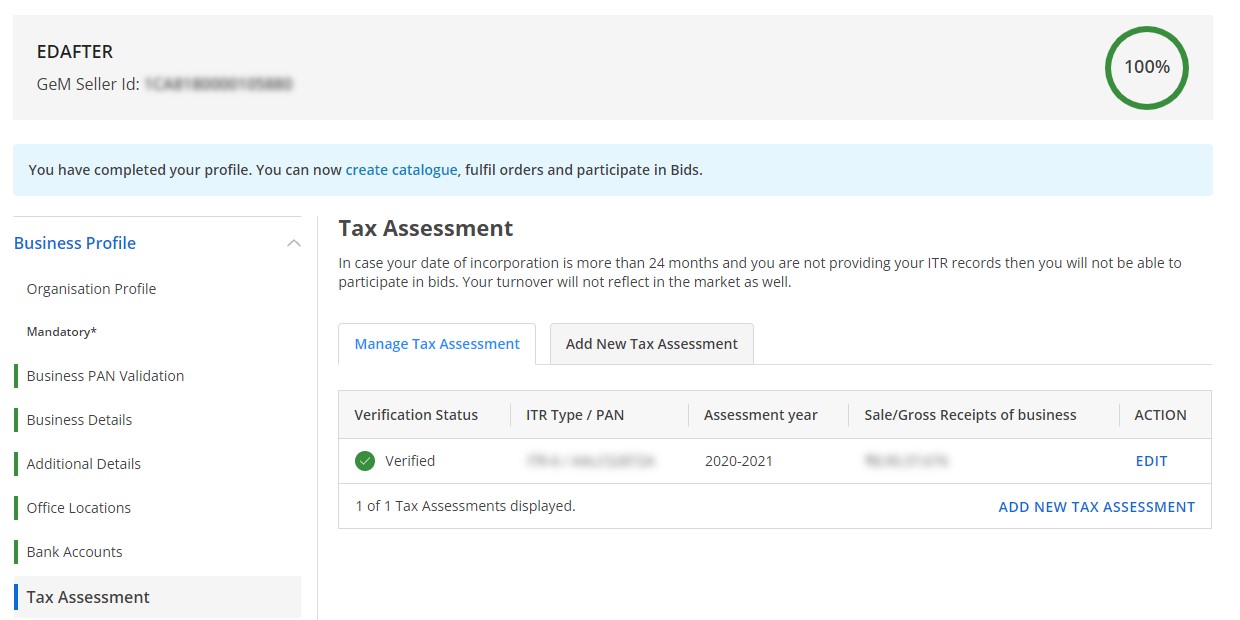

- Manage Tax Assessment

- Add new Tax Assessment

Example:

| Verification Status | ITR Type / PAN | Assessment year | Sale/Gross Receipts of business | ACTION |

|---|---|---|---|---|

| ✅ Verified | ITR-6 / AALXXXXXXX | 2019-2020 | ₹ 9,05,000 | EDIT 1 |

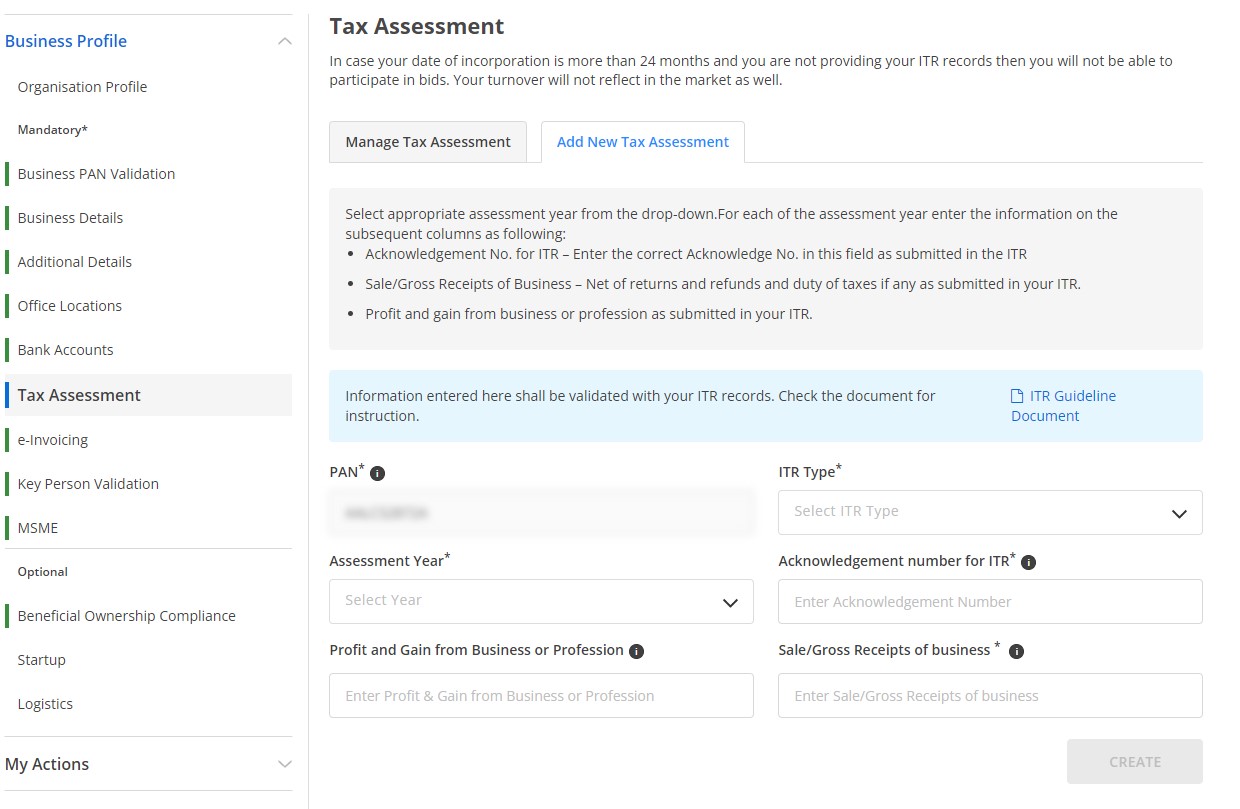

Follow the steps below to add new tax assessment details to your GeM Profile.

note

Select an appropriate assessment year from the drop-down. For each of the assessment year, enter the information on the subsequent columns as following:

- Acknowledgement No. for ITR – Enter the correct Acknowledge No. in this field as submitted in the ITR

- Sale/Gross Receipts of Business – Net of returns and refunds and duty of taxes if any as submitted in your ITR.

- Profit and gain from business or profession as submitted in your ITR.

- PAN - Enter your personal PAN (Key Person's PAN) Number

- ITR Type - Select proper ITR (as per your ITR Acknowledgement)

- Assessment Year - Select Assessment Year

- Acknowledgement number for ITR - Enter acknowledgement number (printed on ITR filling acknowledgement slip)

- Profit and Gain from Business or Profession - Enter Profit and Gain you earned in the assessment year from your business

- Sale/Gross Receipts of business - Enter gross sale of your business

info

Information entered here shall be validated with your ITR records. Please enter all the details with the help of your CA.

Call Now+91 9999119365Email -info@bidz365.com

Unable to complete the profile. Need support?

Contact our expert team to assist you with it

Contact Now

- Edit ITR details↩